Cra Bonus Method . 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. the canada revenue agency (cra) allows two methods for taxing bonuses: The periodic method treats the bonus. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc) provides an easy workaround to calculate taxes on the bonus using the bonus method in order to reduce the tax contributions for you and your employees. We also discuss the periodic method (the.

from www.slideshare.net

54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. We also discuss the periodic method (the. the canada revenue agency (cra) allows two methods for taxing bonuses: the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. The periodic method treats the bonus. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc) provides an easy workaround to calculate taxes on the bonus using the bonus method in order to reduce the tax contributions for you and your employees.

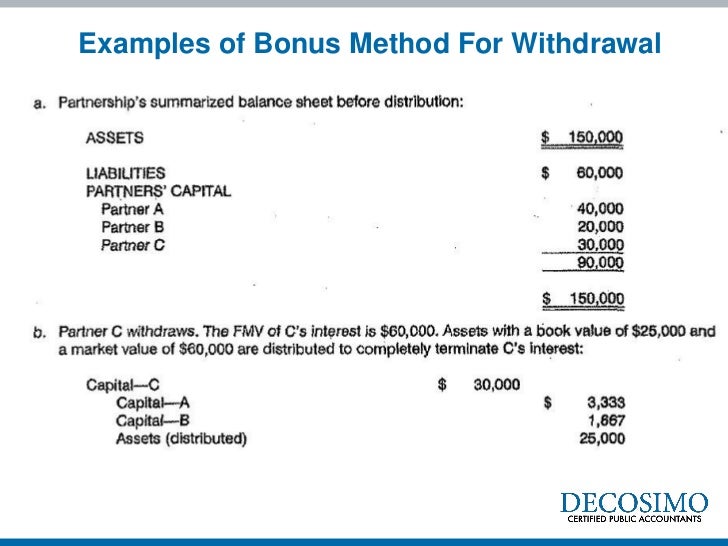

Issues in Partnership Accounting

Cra Bonus Method The periodic method treats the bonus. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc) provides an easy workaround to calculate taxes on the bonus using the bonus method in order to reduce the tax contributions for you and your employees. We also discuss the periodic method (the. the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. the canada revenue agency (cra) allows two methods for taxing bonuses: The periodic method treats the bonus.

From texasbreaking.com

MyCRA Account Login Methods for Opening a CRA Account? Texas Cra Bonus Method the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. the canada revenue agency (cra) allows two methods for taxing bonuses: while wagepoint uses. Cra Bonus Method.

From www.youtube.com

F2P Maplestory(SEA) Pathfinder bossing montage CRA + Bonus Chaos Cra Bonus Method while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc) provides an easy workaround to calculate taxes on the bonus using the bonus method in order to reduce the tax contributions for you and your employees. the canada revenue agency (cra) allows two methods for taxing bonuses: the bonus. Cra Bonus Method.

From easyreviewcourses.teachable.com

Dissolution Admission by Investment ERC Tutorials Cra Bonus Method the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. the canada revenue agency (cra) allows two methods for taxing bonuses: The periodic method treats the bonus. 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions,. Cra Bonus Method.

From www.slideserve.com

PPT Application of the CRA Method PowerPoint Presentation, free Cra Bonus Method We also discuss the periodic method (the. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc) provides an easy workaround to calculate taxes on the bonus using the bonus method in order to reduce the tax contributions for you and your employees. 54 rows this chart will help you. Cra Bonus Method.

From www.slideserve.com

PPT Partnership PowerPoint Presentation, free download ID1654041 Cra Bonus Method 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. the canada revenue agency (cra) allows two methods for taxing bonuses: The periodic method treats. Cra Bonus Method.

From www.therecoveringtraditionalist.com

How To Use Representation In The CRA Method The Recovering Traditionalist Cra Bonus Method 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. the canada revenue agency (cra) allows two methods for taxing bonuses: The periodic method treats the bonus. We also discuss the periodic method (the. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s. Cra Bonus Method.

From www.therecoveringtraditionalist.com

How To Use Representation In The CRA Method The Recovering Traditionalist Cra Bonus Method the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions. Cra Bonus Method.

From www.youtube.com

How To Use Representation In The CRA Method YouTube Cra Bonus Method the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. We also discuss the periodic method (the. while wagepoint uses the periodic method for calculating. Cra Bonus Method.

From www.therecoveringtraditionalist.com

How To Use Representation In The CRA Method The Recovering Traditionalist Cra Bonus Method the canada revenue agency (cra) allows two methods for taxing bonuses: The periodic method treats the bonus. the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions,. Cra Bonus Method.

From primaryflourish.com

How to Use the CRA model to Teach Math Fact Fluency Primary Flourish Cra Bonus Method We also discuss the periodic method (the. 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc) provides an easy workaround to calculate taxes on the bonus using the bonus. Cra Bonus Method.

From www.youtube.com

Advanced Accounting Partnership life cycle Bonus Method YouTube Cra Bonus Method the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. the canada revenue agency (cra) allows two methods for taxing bonuses: 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. while wagepoint uses. Cra Bonus Method.

From www.meridiancu.ca

How to set up CRA direct deposit online Meridian Cra Bonus Method the canada revenue agency (cra) allows two methods for taxing bonuses: the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. The periodic method treats the bonus. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc). Cra Bonus Method.

From www.slideshare.net

Issues in Partnership Accounting Cra Bonus Method 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. We also discuss the periodic method (the. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc) provides an easy workaround to calculate taxes on the bonus using the bonus. Cra Bonus Method.

From www.youtube.com

Bonus Method in Partnership Accounting YouTube Cra Bonus Method the canada revenue agency (cra) allows two methods for taxing bonuses: 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. The periodic method treats. Cra Bonus Method.

From www.pinterest.jp

Curious about how to use representation in the CRA method in your math Cra Bonus Method the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. The periodic method treats the bonus. 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. the canada revenue agency (cra) allows two methods for. Cra Bonus Method.

From www.youtube.com

CRA method for simple addition YouTube Cra Bonus Method the canada revenue agency (cra) allows two methods for taxing bonuses: the bonus tax method is the taxation method used for calculating tax deductions on irregular payments amounts such as bonuses and retroactive. The periodic method treats the bonus. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc). Cra Bonus Method.

From www.pinterest.com

Pin on Fabulous in Fourth Resources Cra Bonus Method while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc) provides an easy workaround to calculate taxes on the bonus using the bonus method in order to reduce the tax contributions for you and your employees. the canada revenue agency (cra) allows two methods for taxing bonuses: 54 rows. Cra Bonus Method.

From bbts.ca

Understanding CRA Arbitrary Assessments BBTS Accountax Inc. Cra Bonus Method 54 rows this chart will help you determine whether or not to deduct canada pension plan (cpp) contributions, employment insurance. while wagepoint uses the periodic method for calculating taxes on bonuses, the cra’s payroll deductions online calculator (pdoc) provides an easy workaround to calculate taxes on the bonus using the bonus method in order to reduce the tax. Cra Bonus Method.